I'm Dr. Tomoya Suzuki.

Professor of

Ibaraki University,

Master of Financial Technical Analysis (MFTA).

Professor of

Ibaraki University,

Master of Financial Technical Analysis (MFTA).

My office:

College of Engineering, Department of Intelligent Systems Engineering.

My laboratory:

Complex Data Science Lab. at E2-809 and E2-807.

My room: E2-808.

My email: tomoya.suzuki.lab[at]vc.ibaraki.ac.jp

>> Go to Japanese page

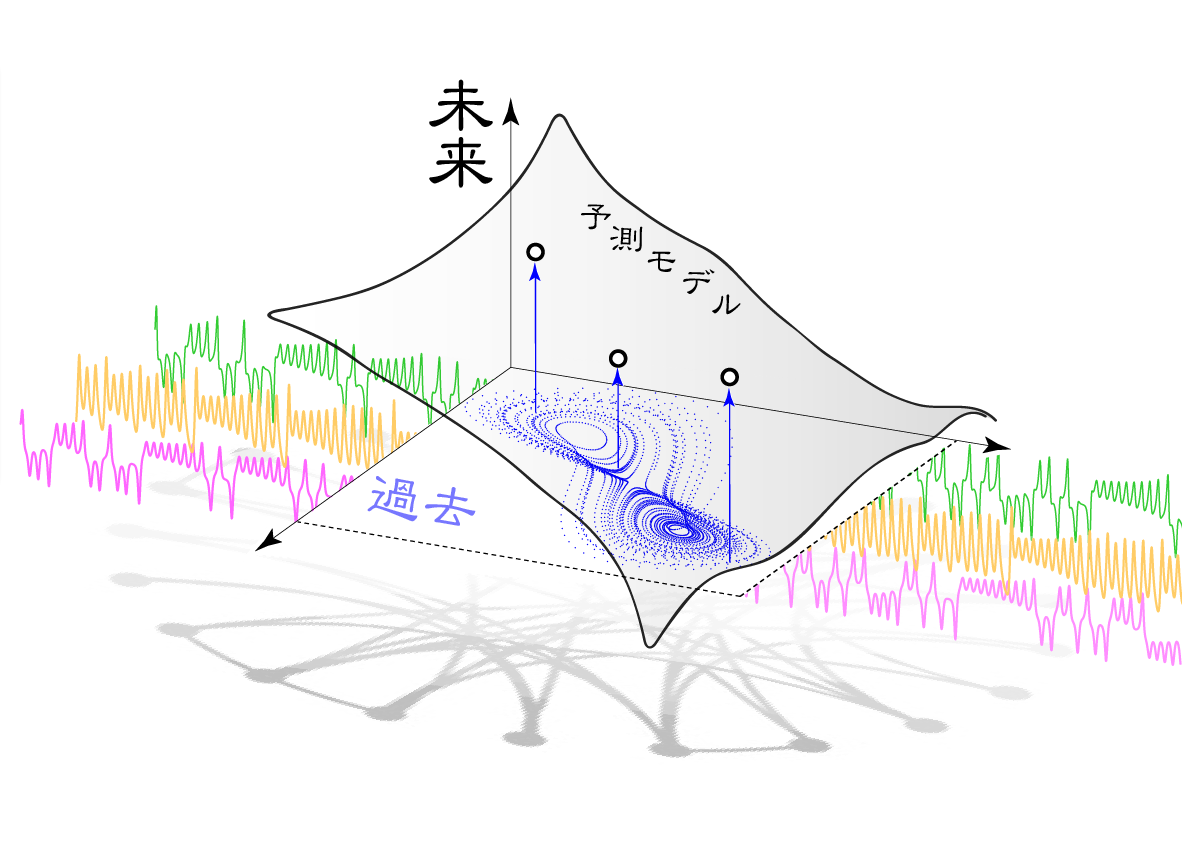

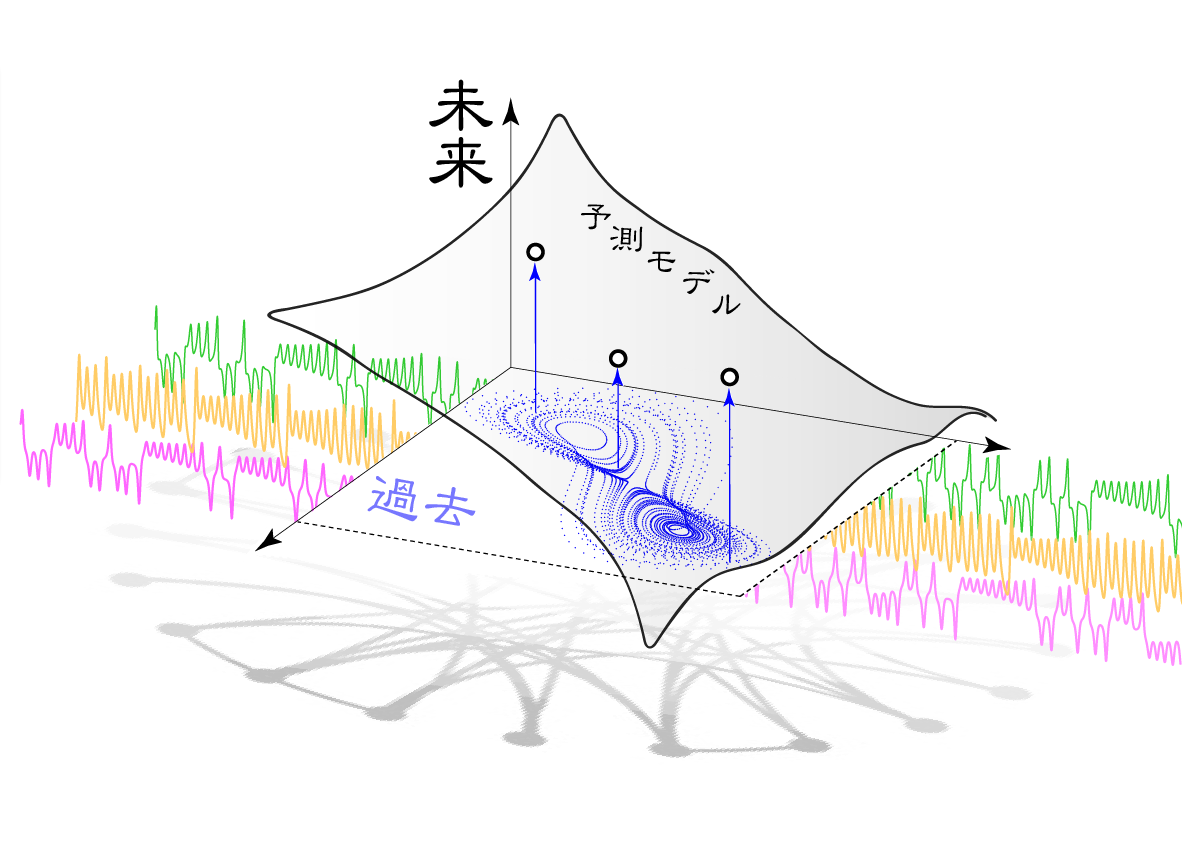

Research subject: Nonlinear time series analysis and its applications for complex systems

Keywords: Financial Technical Analysis, Machine learning, Optimization, Nonlinear time-series analysis, Algorithm trading, etc.

Affiliation society: the Nippon Technical Analysts Association (NTAA); the Securities Analysis Association of Japan (SAAJ)

the Institute of Electronics, Information and Communication Engineers Information and Systems Society (IEICE);

the Information Processing Society of Japan (IPSJ)

List of my achievement:

Research,

Education

Seminar

Profile:

Profile:

2002-2005 Doctor of Science: Department of Physics, Tokyo University of Science

2005-2006 Assistant: Department of Electrical and Electronic Engineering, Tokyo Denki University

2006-2009 Lecture: Department of Information Systems Design, Doshisha University

2009-2016 Associate Professor: Department of Intelligent Systems Engineering, Ibaraki University

2016- Professor: Department of Intelligent Systems Engineering, Ibaraki University

Social Activities:

2006-2017 Publication Editor of IPSJ Journal: Transactions on Mathematical Modeling and its Applications (TOM)

2013-2017 Committee Member of IPSJ Study Group: Mathematical Modeling and Problem Solving (MPS)

2012- Secretary of Quantitative Research, Nippon Technical Analysts Association (NTAA)

2014- Councilor of Nippon Technical Analysts Association (NTAA)

Membership of Academic Societies:

The Institute of Electronics, Information and Communication Engineers (IEICE)

The Japanese Society for Artificial Intelligence

Information Processing Society of Japan (IPSJ)

The Physical Society of Japan (JPS)

Nippon Technical Analysts Association (NTAA)

Selected Publications:

[1] Tomoya Suzuki, Tohru Ikeguchi, Masuo Suzuki:

``A Model of Complex Behavior of Interbank Exchange Markets,''

Physica A, Vol.337, pp.196-218, 2004. [PDF]

[2] Tomoya Suzuki, Tohru Ikeguchi, Masuo Suzuki:

``Effect of Data Windows on the Models of Surrogate Data,''

Physical Review E, Vol.71, 056708, 2005. [PDF]

[3] Tomoya Suzuki, Tohru Ikeguchi, Masuo Suzuki:

``Evaluating nonlinearity and validity of nonlinear modeling for complex time series,''

Physical Review E, Vol.76, No.4, 046202, 2007. [PDF]

[4] Tomoya Suzuki, Yuta Ueoka, Haruki Sato:

``Estimating Structure of Multivariate Systems with Genetic Algorithms for Nonlinear Prediction,''

Physical Review E, Vol.80, No.6, 066208, 2009. [PDF]

[5] Tomoya Suzuki:

``Appropriate Time Scales for Nonlinear Analyses of Deterministic Jump Systems,''

Physical Review E, Vol.83, No.6, 066203, 2011. [html]

[6] Tomoya Suzuki, Kazuya Nakata:

``Risk Reduction for Nonlinear Prediction and its Application to the Surrogate Data Test,''

Physica D, Vol.266, No.1, pp.1-82, 2014. [html]

Publication of Technical Analysis:

[1] Yamada Masaaki, Tomoya Suzuki:

``New Technical Indicator by Using the Bipower Variation,'' Technical Analysts Journal, Vol.1, pp.1-9, Best paper award, 2014. [image]

[2] Tomoya Suzuki, Taiga Hayashi:

``Spatiotemporal Technical Analysis Based on Deterministic Nonlinear Prediction,'' IEICE Transactions A, Vol.J98-A, No.2, pp.237-246, 2015. [PDF]

[3] Koizumi Hiroya, Tomoya Suzuki:

``Technical Investment Strategy by Using the Reaction of Market Jumps,'' Technical Analysts Journal, Vol.2, pp.1-11, Best paper award, 2015. [image]

[4] Tomoya Suzuki, Masaru Narimatsu:

``Cointegrated Pairs Trading by Using Sudden Arbitrage Opportunities,'' Technical Analysts Journal, Vol.2, pp.12-22, 2015. [image]

[5] Tomoya Suzuki, Yushi Ohkura:

``Financial Technical Indicator Based on Chaotic Bagging Predictors for Adaptive Stock Selection in Japanese and American Markets,''

Physica A, Vol.442, pp.50-66, 2016. [html]

[It might be the first paper of Technical Analysis in Physics.]

Publication of Portfolio Theory:

[1] Satoshi Inose, Tomoya Suzuki:

``Portfolio Selection Based on Nonlinear Time Series Prediction,''

IEICE Transactions ACVol.J96-A No.7 pp.410-422, 2013. [html]

[2] Inose Satoshi, Tomoya Suzuki, Kazuo Yamanaka:

``Nonlinear Portfolio Model and its Rebalance Strategy,'' Nonlinear Theory and Its Applications, IEICE,Vol.4,No.4,pp.351-364, 2013.

[html]

[3] Kai Morimoto, Masahiro Saito, Satoshi Inose, Atsushi Kannari, Tomoya Suzuki:

``Application of the Principal Components Analysis to the Nonlinear Portfolio Model,''

Journal of Signal Processing, Vol.18, No.4, pp.177-180, 2014. [PDF]

[4] Tomoya Suzuki, Kiyoharu Tanaka:

``Mean-Variance Portfolio Model Modified by Nonlinear Bagging Predictors,'' Journal of Signal Processing, Vol.18, No.6, pp.283-290, 2014.

[PDF]

Address:

Department of Intelligent Systems Engineering,

College of Engineering, Ibaraki University,

4-12-1 Nakanarisawa-cho, Hitachi, Ibaraki 316-8511, Japan

E-mail:

tomoya.suzuki.lab(a)vc.ibaraki.ac.jp

Professor of

Ibaraki University,

Master of Financial Technical Analysis (MFTA).

Professor of

Ibaraki University,

Master of Financial Technical Analysis (MFTA). Profile:

Profile: