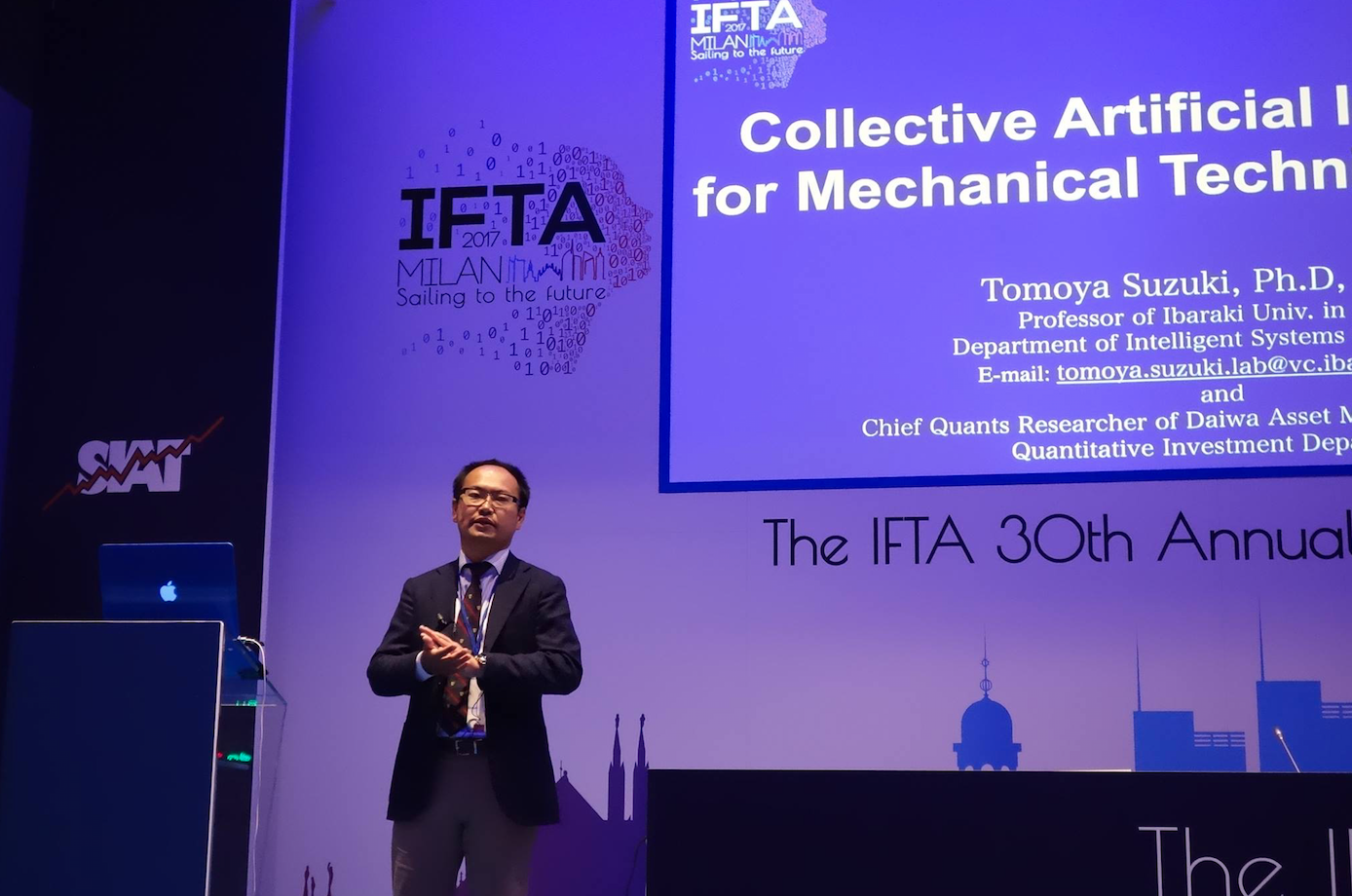

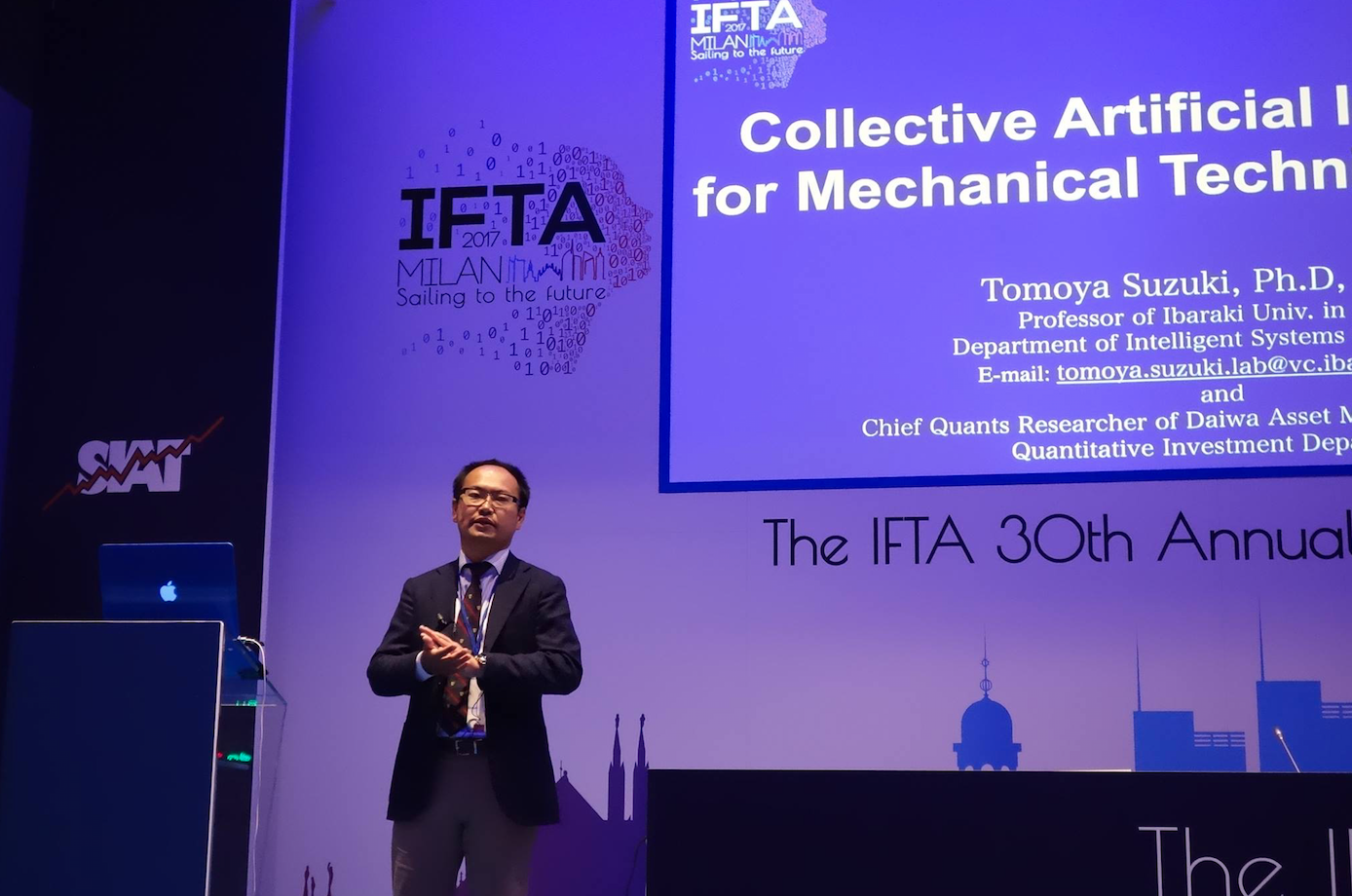

I'm Dr. Tomoya Suzuki.

Professor of

Ibaraki University,

Master of Financial Technical Analysis (MFTA).

Professor of

Ibaraki University,

Master of Financial Technical Analysis (MFTA).

My office:

College of Engineering, Department of Intelligent Systems Engineering.

My laboratory:

Complex Data Science Lab. at E2-809 and E2-807.

My room: E2-808.

My email: tomoya.suzuki.lab[at]vc.ibaraki.ac.jp

>> Go to Japanese page

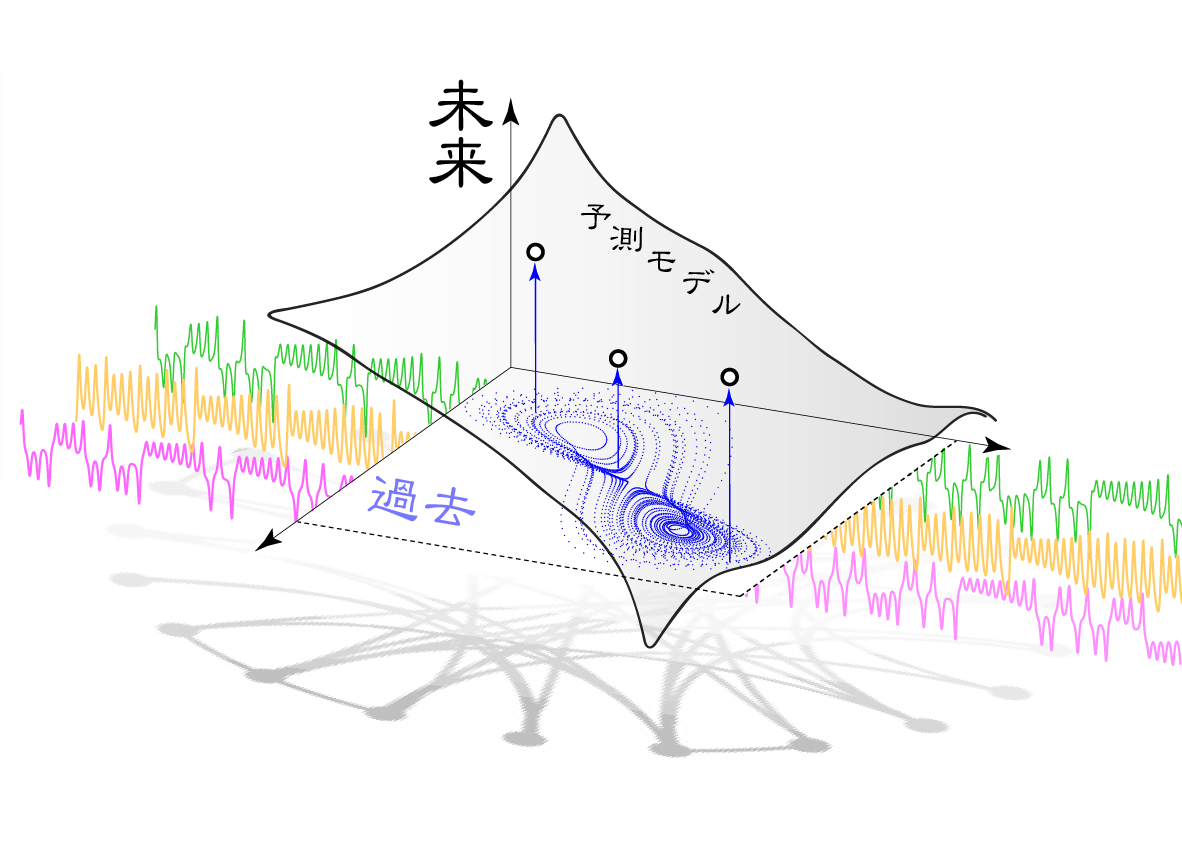

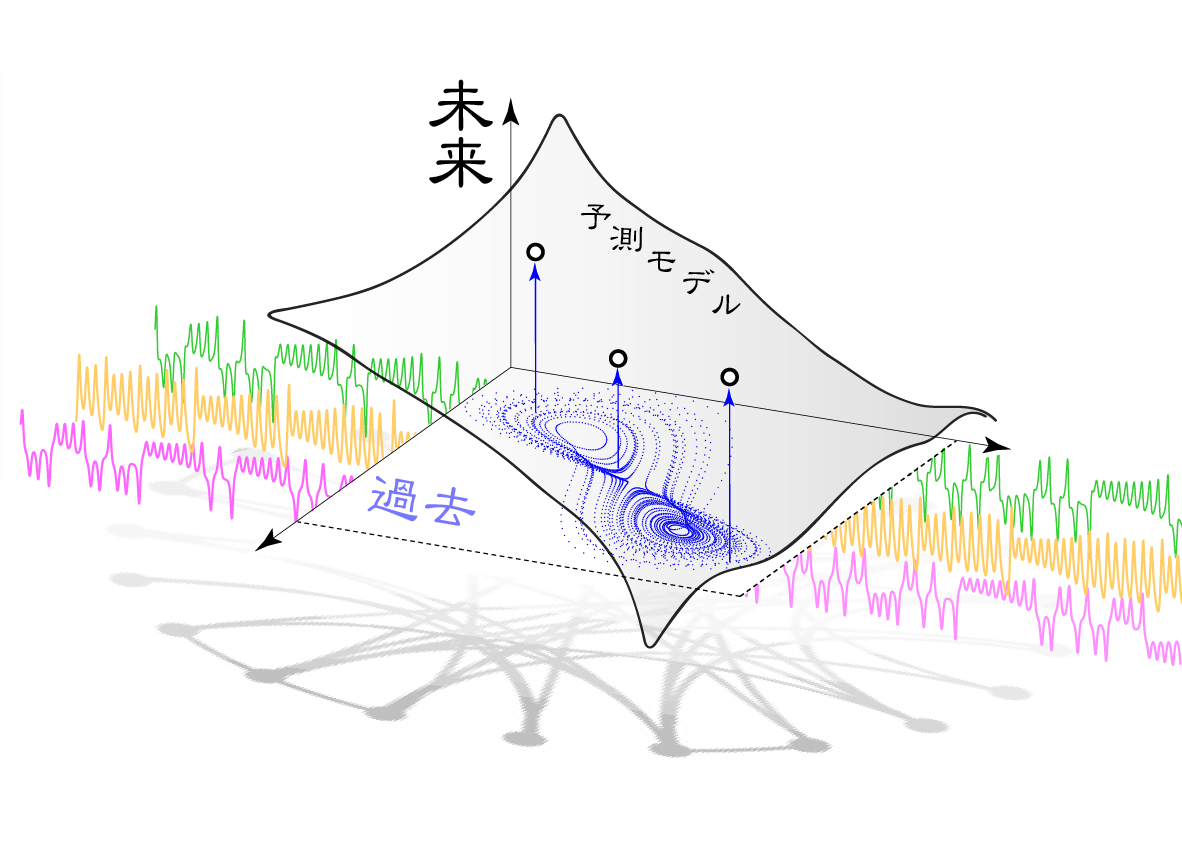

Research subject: Nonlinear time series analysis and its applications for complex systems

Keywords: Financial Technical Analysis, Machine learning, Optimization, Nonlinear time-series analysis, Algorithm trading, etc.

Affiliation society: the Nippon Technical Analysts Association (NTAA); the Securities Analysis Association of Japan (SAAJ)

the Institute of Electronics, Information and Communication Engineers Information and Systems Society (IEICE);

the Information Processing Society of Japan (IPSJ)

List of my achievement:

Research,

Education

Seminar

Profile:

Profile:

2002-2005 Doctor of Science: Department of Physics, Tokyo University of Science

2005-2006 Assistant: Department of Electrical and Electronic Engineering, Tokyo Denki University

2006-2009 Lecture: Department of Information Systems Design, Doshisha University

2009-2016 Associate Professor: Department of Intelligent Systems Engineering, Ibaraki University

2016- Professor: Department of Intelligent Systems Engineering, Ibaraki University

Social Activities:

2014- Councilor of Nippon Technical Analysts Association (NTAA)

2017.10- Chief Quants Researcher of Daiwa Asset Management Co. Ltd.

2019.10- Innovation Advisor of Ibaraki Prefecture

2019.10- Director of International Federation of Technical Analysts (IFTA)

Membership of Academic Societies:

The Institute of Electronics, Information and Communication Engineers (IEICE)

The Japanese Society for Artificial Intelligence

Nippon Technical Analysts Association (NTAA)

The Securities �Analysts Association of Japan (SAAJ)

Selected Publications:

[1] Tomoya Suzuki, Tohru Ikeguchi, Masuo Suzuki:

``A Model of Complex Behavior of Interbank Exchange Markets,''

Physica A, Vol.337, pp.196-218, 2004. [PDF]

[2] Tomoya Suzuki, Tohru Ikeguchi, Masuo Suzuki:

``Effect of Data Windows on the Models of Surrogate Data,''

Physical Review E, Vol.71, 056708, 2005. [PDF]

[3] Tomoya Suzuki, Tohru Ikeguchi, Masuo Suzuki:

``Evaluating nonlinearity and validity of nonlinear modeling for complex time series,''

Physical Review E, Vol.76, No.4, 046202, 2007. [PDF]

[4] Tomoya Suzuki, Yuta Ueoka, Haruki Sato:

``Estimating Structure of Multivariate Systems with Genetic Algorithms for Nonlinear Prediction,''

Physical Review E, Vol.80, No.6, 066208, 2009. [PDF]

[5] Tomoya Suzuki:

``Appropriate Time Scales for Nonlinear Analyses of Deterministic Jump Systems,''

Physical Review E, Vol.83, No.6, 066203, 2011. [html]

[6] Tomoya Suzuki, Kazuya Nakata:

``Risk Reduction for Nonlinear Prediction and its Application to the Surrogate Data Test,''

Physica D, Vol.266, No.1, pp.1-82, 2014. [html]

Publication of Technical Analysis:

[1] Yamada Masaaki, Tomoya Suzuki:

``New Technical Indicator by Using the Bipower Variation,'' Technical Analysts Journal, Vol.1, pp.1-9, Best paper award, 2014. [image]

[2] Tomoya Suzuki, Taiga Hayashi:

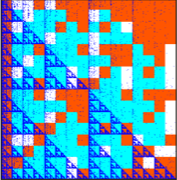

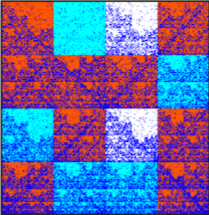

``Spatiotemporal Technical Analysis Based on Deterministic Nonlinear Prediction,'' IEICE Transactions A, Vol.J98-A, No.2, pp.237-246, 2015. [PDF]

[3] Koizumi Hiroya, Tomoya Suzuki:

``Technical Investment Strategy by Using the Reaction of Market Jumps,'' Technical Analysts Journal, Vol.2, pp.1-11, Best paper award, 2015. [image]

[4] Tomoya Suzuki, Masaru Narimatsu:

``Cointegrated Pairs Trading by Using Sudden Arbitrage Opportunities,'' Technical Analysts Journal, Vol.2, pp.12-22, 2015. [image]

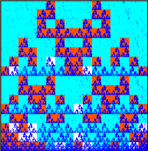

[5] Tomoya Suzuki, Yushi Ohkura:

``Financial Technical Indicator Based on Chaotic Bagging Predictors for Adaptive Stock Selection in Japanese and American Markets,''

Physica A, Vol.442, pp.50-66, 2016. [html]

[It might be the first paper of Technical Analysis in Physics.]

Publication of Portfolio Theory:

[1] Satoshi Inose, Tomoya Suzuki:

``Portfolio Selection Based on Nonlinear Time Series Prediction,''

IEICE Transactions ACVol.J96-A No.7 pp.410-422, 2013. [html]

[2] Inose Satoshi, Tomoya Suzuki, Kazuo Yamanaka:

``Nonlinear Portfolio Model and its Rebalance Strategy,'' Nonlinear Theory and Its Applications, IEICE,Vol.4,No.4,pp.351-364, 2013.

[html]

[3] Kai Morimoto, Masahiro Saito, Satoshi Inose, Atsushi Kannari, Tomoya Suzuki:

``Application of the Principal Components Analysis to the Nonlinear Portfolio Model,''

Journal of Signal Processing, Vol.18, No.4, pp.177-180, 2014. [PDF]

[4] Tomoya Suzuki, Kiyoharu Tanaka:

``Mean-Variance Portfolio Model Modified by Nonlinear Bagging Predictors,'' Journal of Signal Processing, Vol.18, No.6, pp.283-290, 2014.

[PDF]

Address:

Department of Intelligent Systems Engineering,

College of Engineering, Ibaraki University,

4-12-1 Nakanarisawa-cho, Hitachi, Ibaraki 316-8511, Japan

E-mail:

tomoya.suzuki.lab(a)vc.ibaraki.ac.jp

Professor of

Ibaraki University,

Master of Financial Technical Analysis (MFTA).

Professor of

Ibaraki University,

Master of Financial Technical Analysis (MFTA). Profile:

Profile: