複雑現象のメカニズムを探り,新しい人工物の創造に役立てる研究をしています.また,学生の向上心を実力に変えるお手伝いをしております.

|

研究室紹介

もともと確率論の観点からギャンブルに興味があり,競馬のオッズって本当に妥当なのか疑い, 学生時代にわざわざデータを集めてオッズと勝率の関係を調べたことがあります. すると見事に強い相関関係が表れ(一見あたりまえに思えますが), これはオッズを導いた大衆は勝ち馬の勝率を事前に予測できていることに相当するため,大変驚きました. これが「集合知」と呼ばれる現象なのですが,民主主義や金融市場の妥当性も同様のメカニズムで説明でき, さらに組合せ最適化問題や機械学習(人工知能)といった工学的分野にも応用できることを知り,強い関心を持ちました. また,囲碁チャンピオンに勝利したあのAlphaGoも複数の人工知能を連携して高度な知能を実現しています. 今後はより明示的に人工知能を集団化させる研究が増えると思います. そこで我々はこの枠組みを「集合知AI」と称し,FinTech (Finance + Technology) としてスマートな自動運用システムの開発を推進しています.

【テクニカル分析に関する論文】

[1] 山田雅章, 鈴木智也:``Bipower Variation を用いた新しいテクニカル指標,'' Technical Analysts Journal, Vol.1, pp.1-9, 優秀賞, 2014. [image]

[2] 鈴木智也, 林大賀:``決定論的非線形予測に基づいた時空間テクニカル分析,'' 電子情報通信学会論文誌A, Vol.J98-A, No.2, pp.237-246, 2015. [PDF]

[3] 小泉洋八, 鈴木智也:``金融市場のジャンプに対する反応を利用したテクニカル売買戦略,'' Technical Analysts Journal, Vol.2, pp.1-11, 優秀賞, 2015. [image]

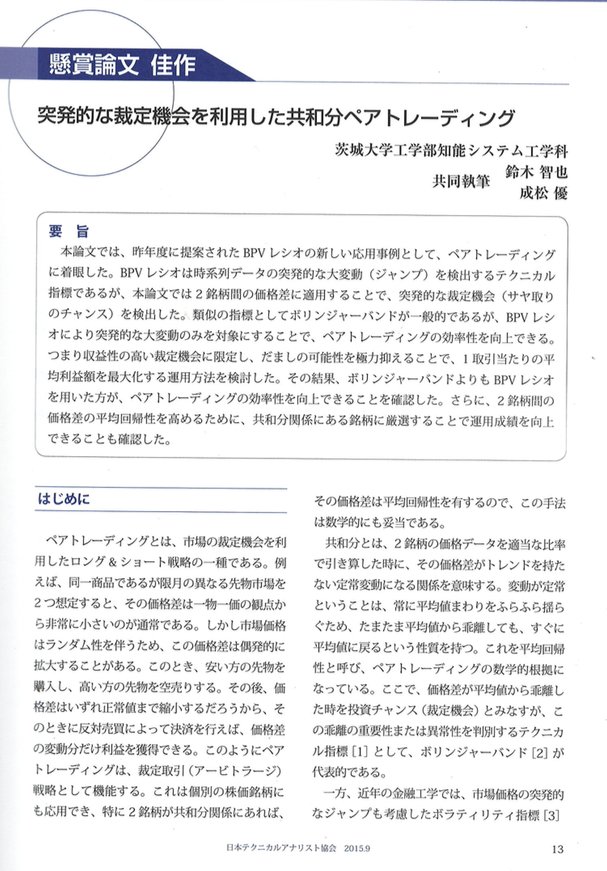

[4] 鈴木智也, 成松優:``突発的な裁定機会を利用した共和分ペアトレーディング,'' Technical Analysts Journal, Vol.2, pp.12-22, 2015. [image]

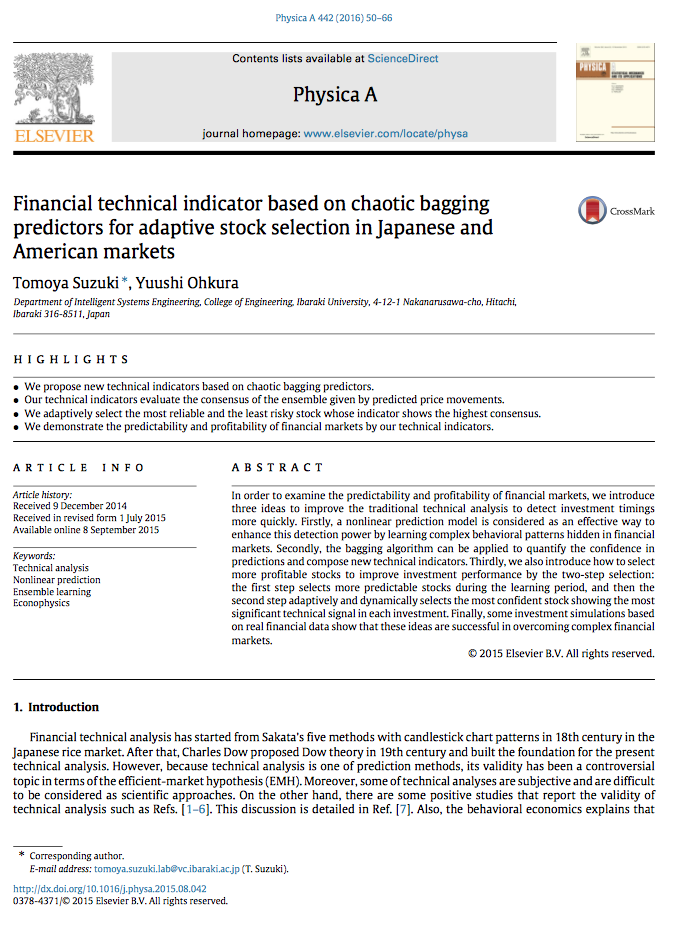

[5] Tomoya Suzuki, Yushi Ohkura:``Financial Technical Indicator Based on Chaotic Bagging Predictors for Adaptive Stock Selection in Japanese and American Markets,'' Physica A, Vol.442, pp.50-66, 2016. [html] 【おそらくテクニカル分析が物理学として扱われる初めての論文です】

【ポートフォリオ理論に関する論文】

[1] 猪瀬悟史, 鈴木智也:``ポートフォリオ構築問題における非線形時系列予測モデルの活用,'' 電子情報通信学会論文誌A, Vol.J96-A, No.7, pp.410-422, 2013. [html]

[2] Inose Satoshi, Tomoya Suzuki, Kazuo Yamanaka:``Nonlinear Portfolio Model and its Rebalance Strategy,'' Nonlinear Theory and Its Applications, IEICE,Vol.4,No.4,pp.351-364, 2013. [html]

[3] Kai Morimoto, Masahiro Saito, Satoshi Inose, Atsushi Kannari, Tomoya Suzuki:``Application of the Principal Components Analysis to the Nonlinear Portfolio Model,'' Journal of Signal Processing, Vol.18, No.4, pp.177-180, 2014. [PDF]

[4] Tomoya Suzuki, Kiyoharu Tanaka:``Mean-Variance Portfolio Model Modified by Nonlinear Bagging Predictors,'' Journal of Signal Processing, Vol.18, No.6, pp.283-290, 2014. [PDF]

【主要な研究論文】

[1] Tomoya Suzuki, Tohru Ikeguchi, Masuo Suzuki:``A Model of Complex Behavior of Interbank Exchange Markets,'' Physica A, Vol.337, pp.196-218, 2004. [PDF]

[2] Tomoya Suzuki, Tohru Ikeguchi, Masuo Suzuki:``Effect of Data Windows on the Models of Surrogate Data,'' Physical Review E, Vol.71, 056708, 2005. [PDF]

[3] Tomoya Suzuki, Tohru Ikeguchi, Masuo Suzuki:``Evaluating nonlinearity and validity of nonlinear modeling for complex time series,'' Physical Review E, Vol.76, No.4, 046202, 2007. [PDF]

[4] Tomoya Suzuki, Yuta Ueoka, Haruki Sato:``Estimating Structure of Multivariate Systems with Genetic Algorithms for Nonlinear Prediction,'' Physical Review E, Vol.80, No.6, 066208, 2009. [PDF]

[5] Tomoya Suzuki:``Appropriate Time Scales for Nonlinear Analyses of Deterministic Jump Systems,'' Physical Review E, Vol.83, No.6, 066203, 2011. [html]

[6] Tomoya Suzuki, Kazuya Nakata:

``Risk Reduction for Nonlinear Prediction and its Application to the Surrogate Data Test,'' Physica D, Vol.266, No.1, pp.1-82, 2014. [html]

【その他,いろいろ】:

研究内容については隣のリンクや 大学の研究者総覧をご参照ください.

Go to the presentation at IFTA2013 : Spatiotemporal Technical Analysis by T.Suzuki

日本語版は こちらです.

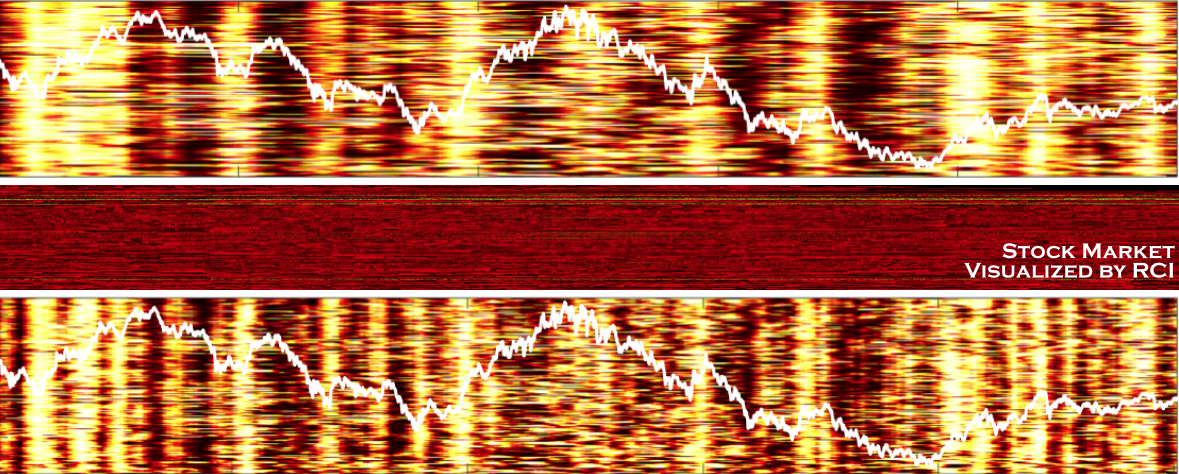

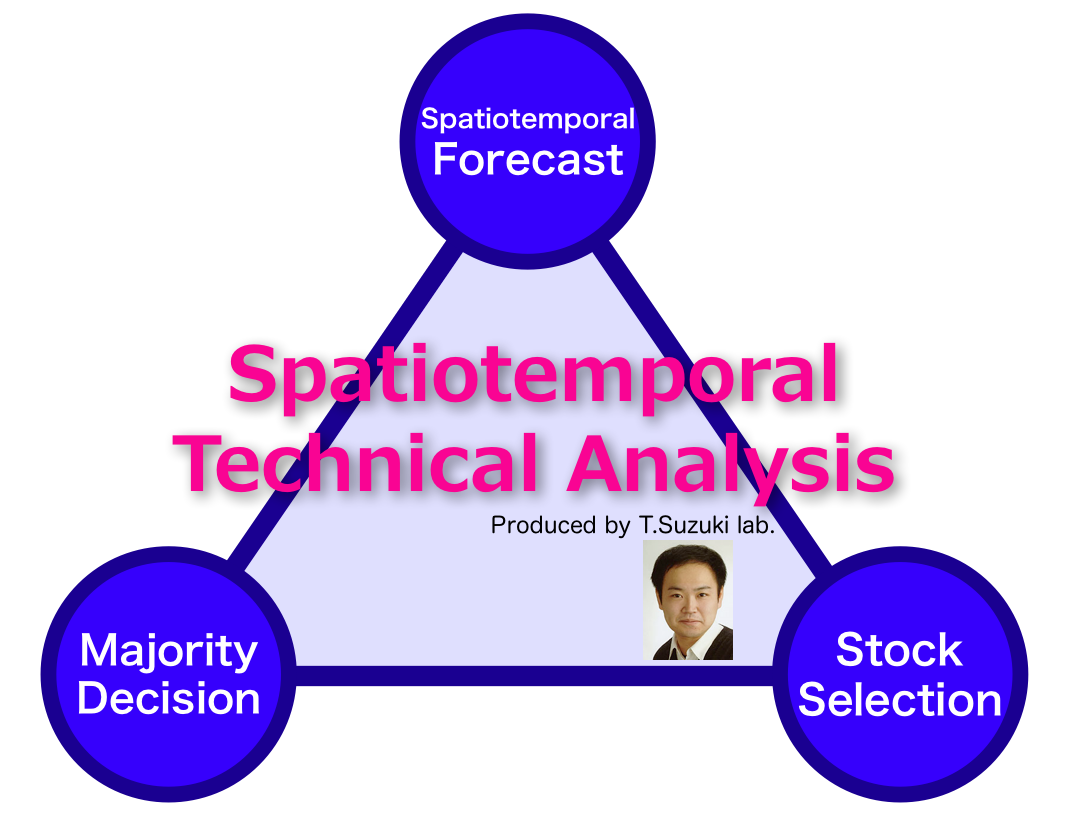

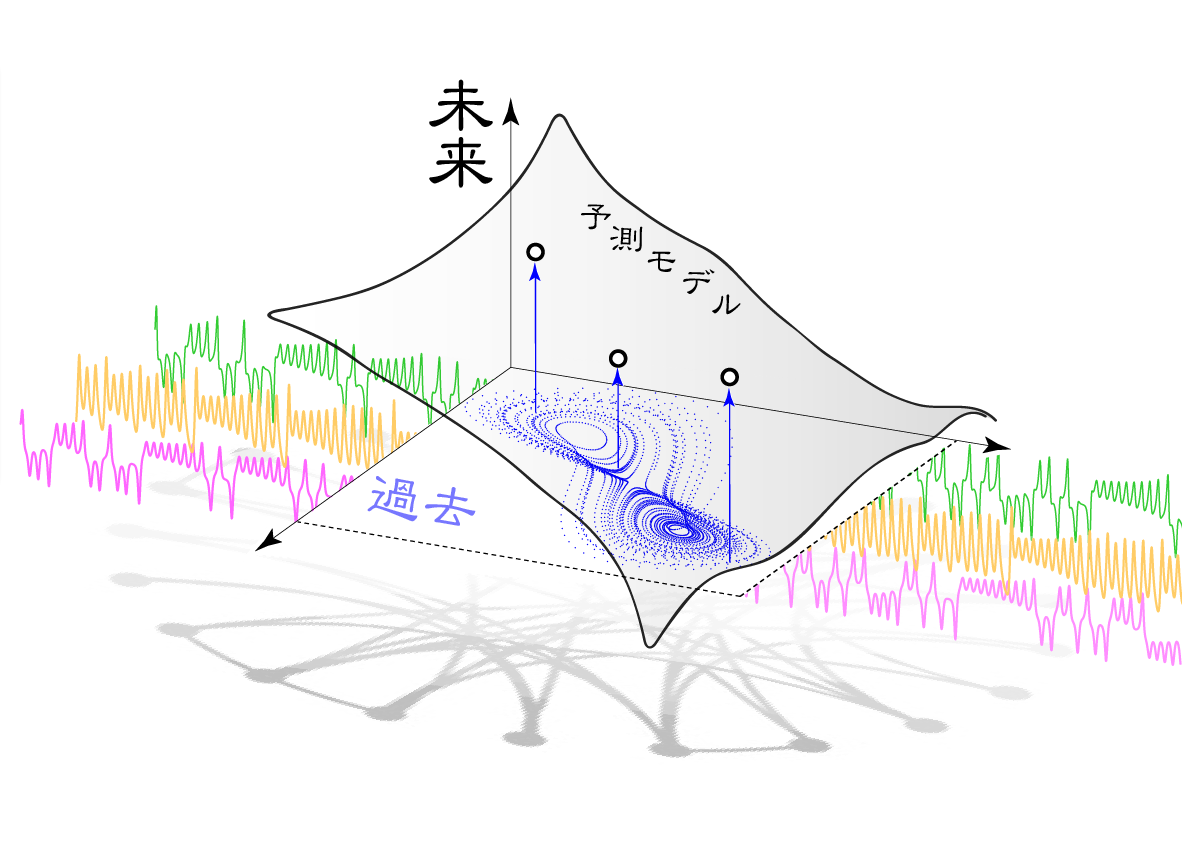

↑ We propose a new technical analysis based on the deterministic prediction theory like chaos. As you know, chaos theory used to be a hot topic in physics and economics, but the boom is almost over. Still, its prediction theory is really simple and can realize the highest level class of prediction models as a nonlinear-multivariate regression. Moreover, it is very familiar with technical analysis because it can be generalized as a formation analysis.

To compose my theory, there are some key ideas to improve prediction accuracy by following the majority decision and to select profitable investment targets in terms of better prediction accuracy. These whole ideas were named "spatiotemporal technical analysis" because the chaos prediction uses local neighbors in a state space to follow the same formation pattern.

Finally, as applications, our theory can be used for the Bollinger bands and for the portfolio theory. This is presented at IFTA2013 conference in San Francisco.

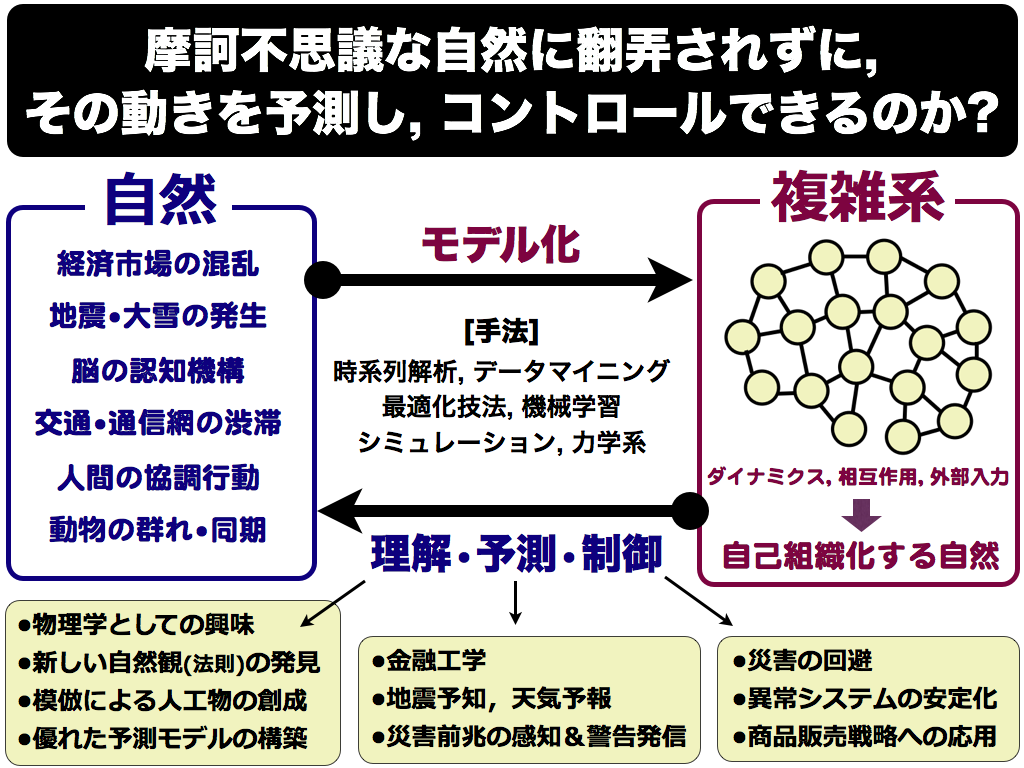

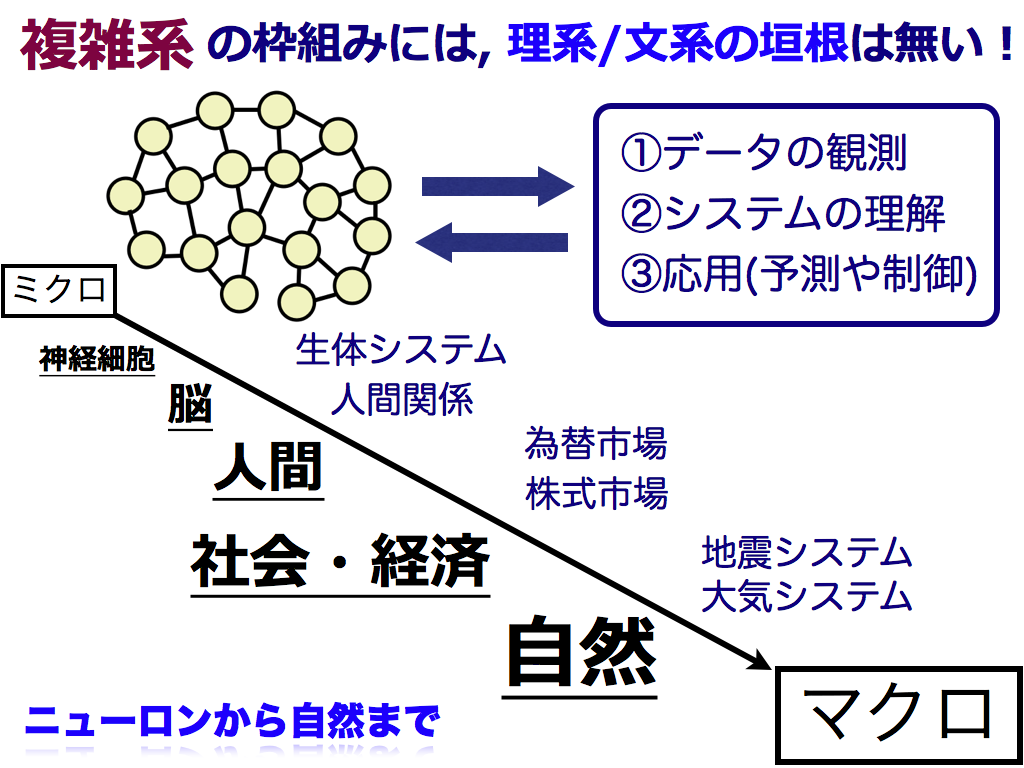

↑ 複雑怪奇な自然現象(=時系列データ)に隠れたルールを発見し, 未来の動きを予測する

↓研究室立ち上げ当初のポスター