Thanks for your visit, but this page is under translation into English. Sorry...

|

About the loboratory

[Publication of Technical Analysis]

[1] Yamada Masaaki, Tomoya Suzuki:``New Technical Indicator by Using the Bipower Variation,'' Technical Analysts Journal, Vol.1, pp.1-9, Best paper award, 2014. [image]

[2] Tomoya Suzuki, Taiga Hayashi:``Spatiotemporal Technical Analysis Based on Deterministic Nonlinear Prediction,'' IEICE Transactions A, Vol.J98-A, No.2, pp.237-246, 2015. [PDF]

[3] Koizumi Hiroya, Tomoya Suzuki:``Technical Investment Strategy by Using the Reaction of Market Jumps,'' Technical Analysts Journal, Vol.2, pp.1-11, Best paper award, 2015. [image]

[4] Tomoya Suzuki, Masaru Narimatsu:``Cointegrated Pairs Trading by Using Sudden Arbitrage Opportunities,'' Technical Analysts Journal, Vol.2, pp.12-22, 2015. [image]

[5] Tomoya Suzuki, Yushi Ohkura:``Financial Technical Indicator Based on Chaotic Bagging Predictors for Adaptive Stock Selection in Japanese and American Markets,'' Physica A, Vol.442, pp.50-66, 2016. [html] [It might be the first paper of Technical Analysis in Physics.]

[Publication of Portfolio Theory]

[1] Satoshi Inose, Tomoya Suzuki:``Portfolio Selection Based on Nonlinear Time Series Prediction,'' IEICE Transactions A,Vol.J96-A No.7 pp.410-422, 2013. [html]

[2] Inose Satoshi, Tomoya Suzuki, Kazuo Yamanaka:``Nonlinear Portfolio Model and its Rebalance Strategy,'' Nonlinear Theory and Its Applications, IEICE,Vol.4,No.4,pp.351-364, 2013. [html]

[3] Kai Morimoto, Masahiro Saito, Satoshi Inose, Atsushi Kannari, Tomoya Suzuki:``Application of the Principal Components Analysis to the Nonlinear Portfolio Model,'' Journal of Signal Processing, Vol.18, No.4, pp.177-180, 2014. [PDF]

[4] Tomoya Suzuki, Kiyoharu Tanaka:``Mean-Variance Portfolio Model Modified by Nonlinear Bagging Predictors,'' Journal of Signal Processing, Vol.18, No.6, pp.283-290, 2014. [PDF]

[Selected Publications]

[1] Tomoya Suzuki, Tohru Ikeguchi, Masuo Suzuki:``A Model of Complex Behavior of Interbank Exchange Markets,'' Physica A, Vol.337, pp.196-218, 2004. [PDF]

[2] Tomoya Suzuki, Tohru Ikeguchi, Masuo Suzuki:``Effect of Data Windows on the Models of Surrogate Data,'' Physical Review E, Vol.71, 056708, 2005. [PDF]

[3] Tomoya Suzuki, Tohru Ikeguchi, Masuo Suzuki:``Evaluating nonlinearity and validity of nonlinear modeling for complex time series,'' Physical Review E, Vol.76, No.4, 046202, 2007. [PDF]

[4] Tomoya Suzuki, Yuta Ueoka, Haruki Sato:``Estimating Structure of Multivariate Systems with Genetic Algorithms for Nonlinear Prediction,'' Physical Review E, Vol.80, No.6, 066208, 2009. [PDF]

[5] Tomoya Suzuki:``Appropriate Time Scales for Nonlinear Analyses of Deterministic Jump Systems,'' Physical Review E, Vol.83, No.6, 066203, 2011. [html]

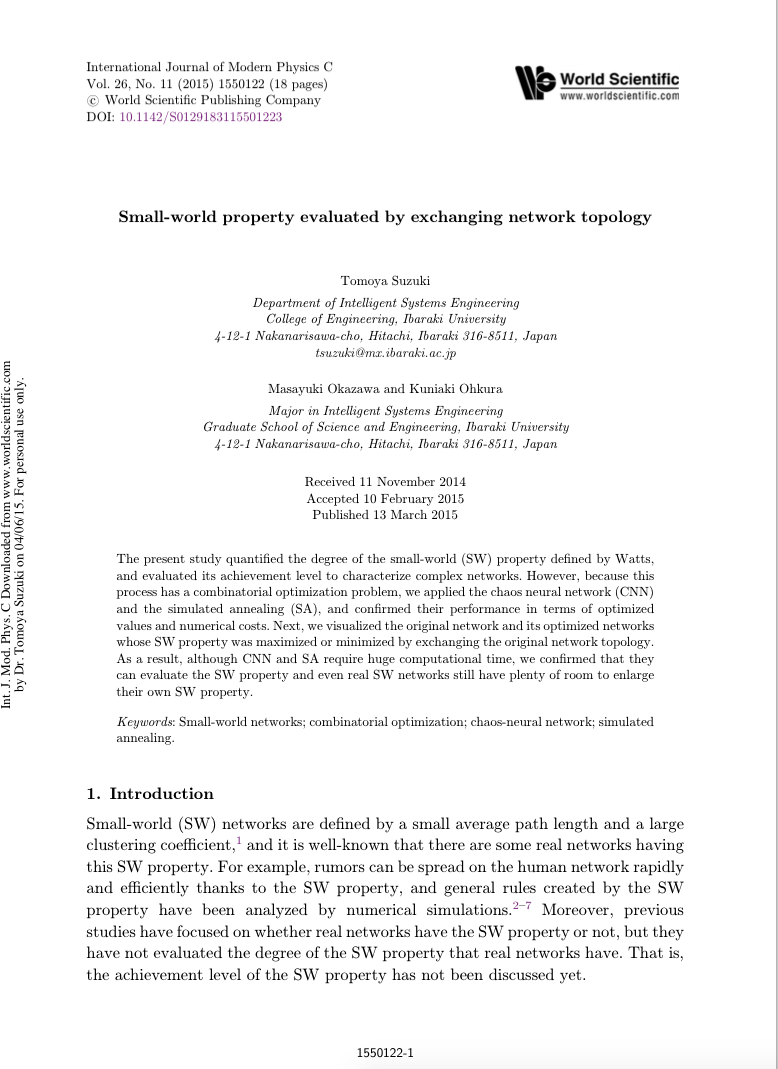

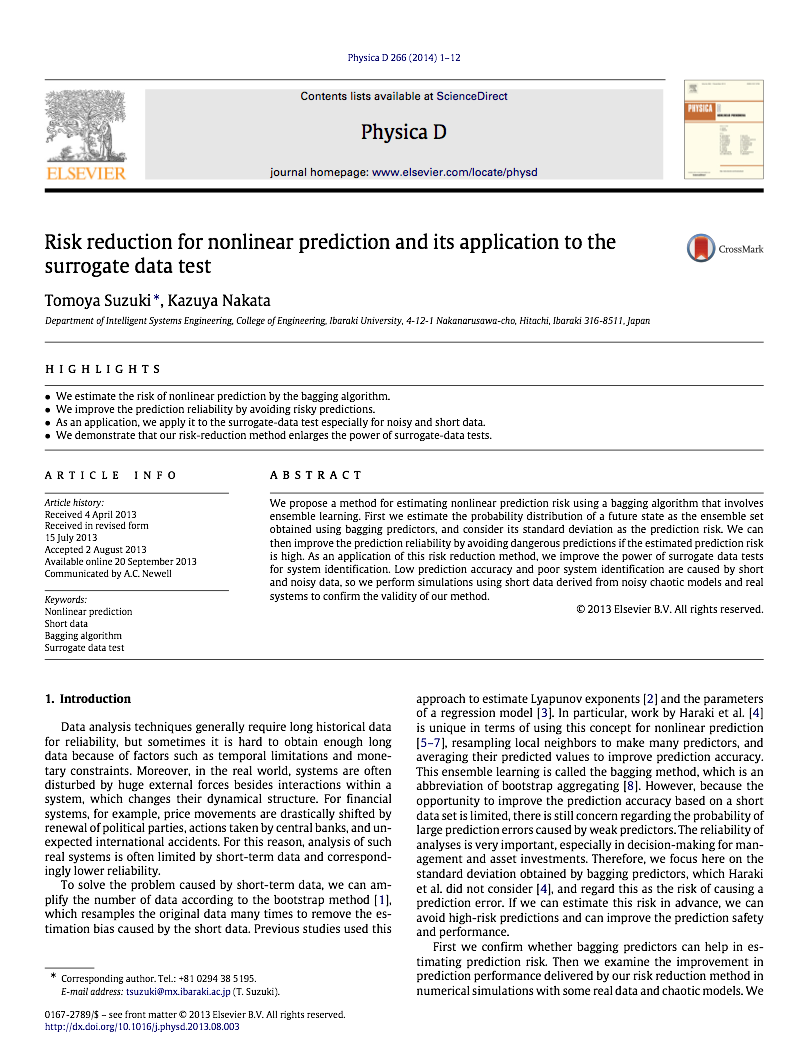

[6] Tomoya Suzuki, Kazuya Nakata:

``Risk Reduction for Nonlinear Prediction and its Application to the Surrogate Data Test,'' Physica D, Vol.266, No.1, pp.1-82, 2014. [html]

[Others]

Go to the presentation at IFTA2013 : Spatiotemporal Technical Analysis by T.Suzuki

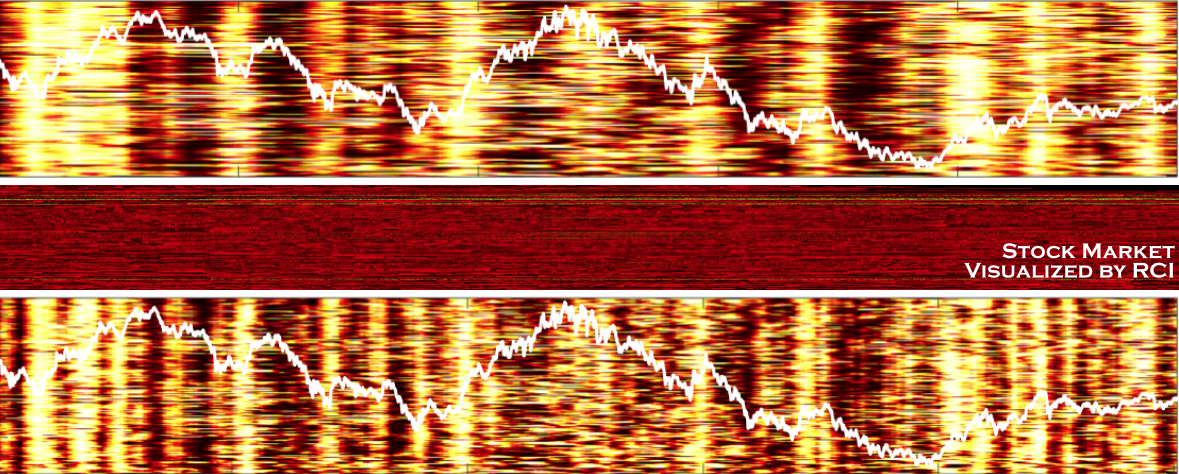

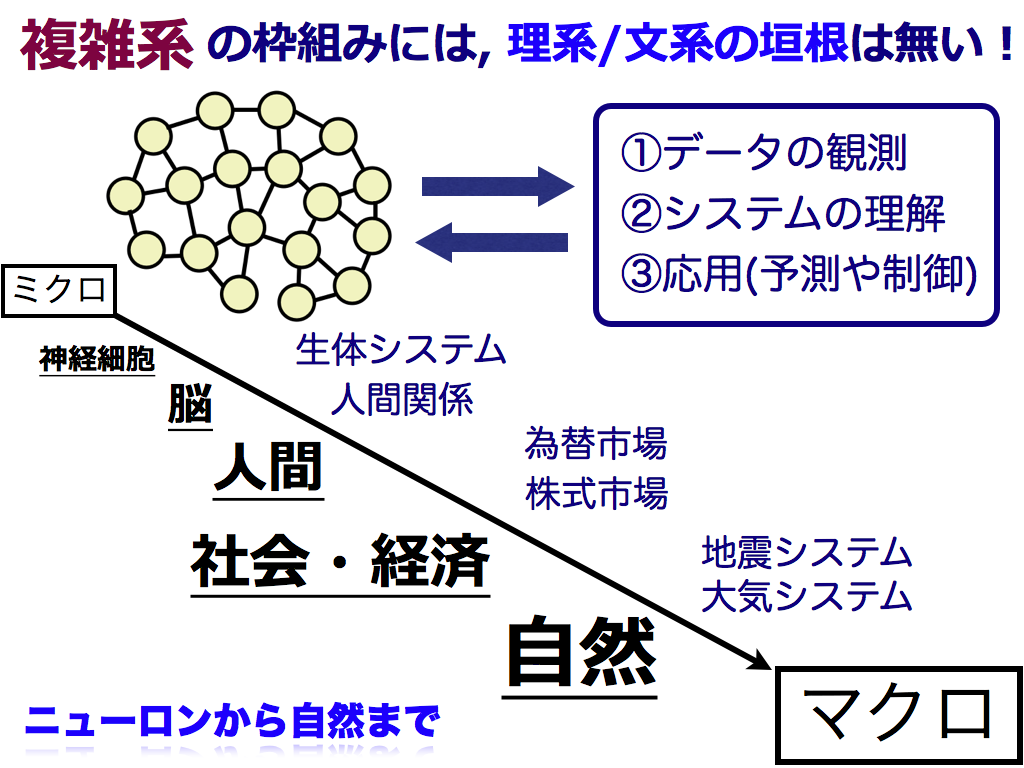

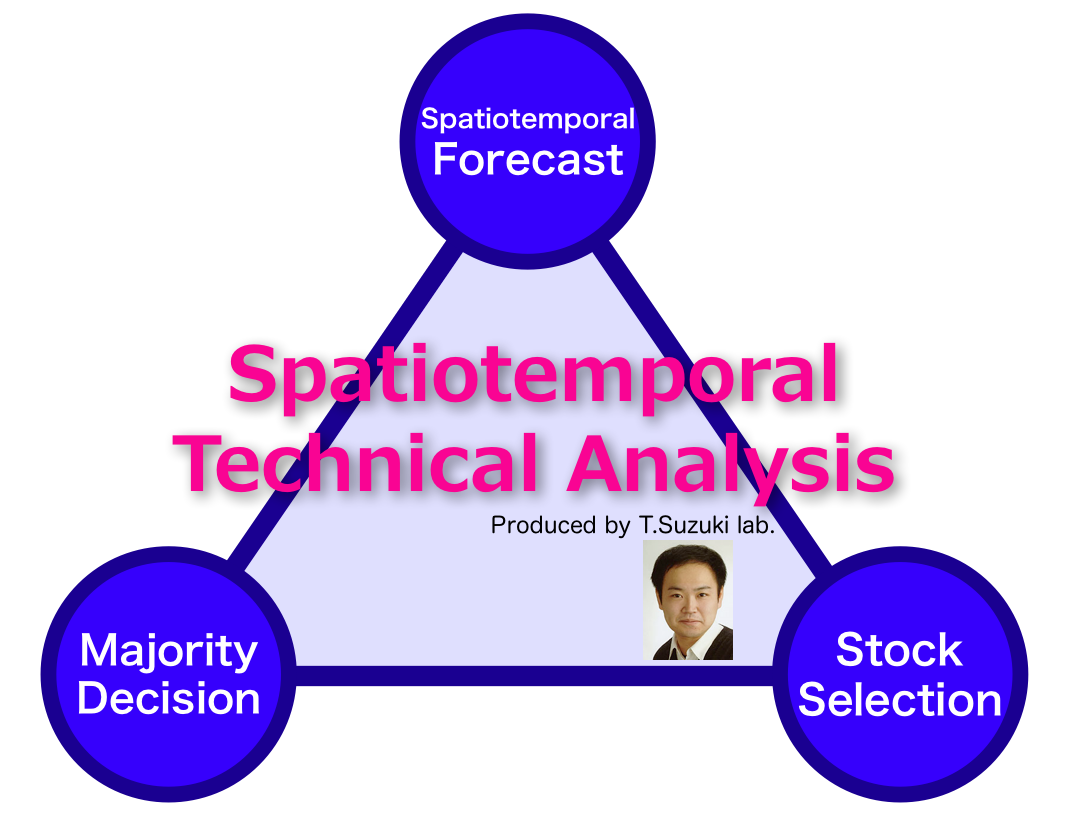

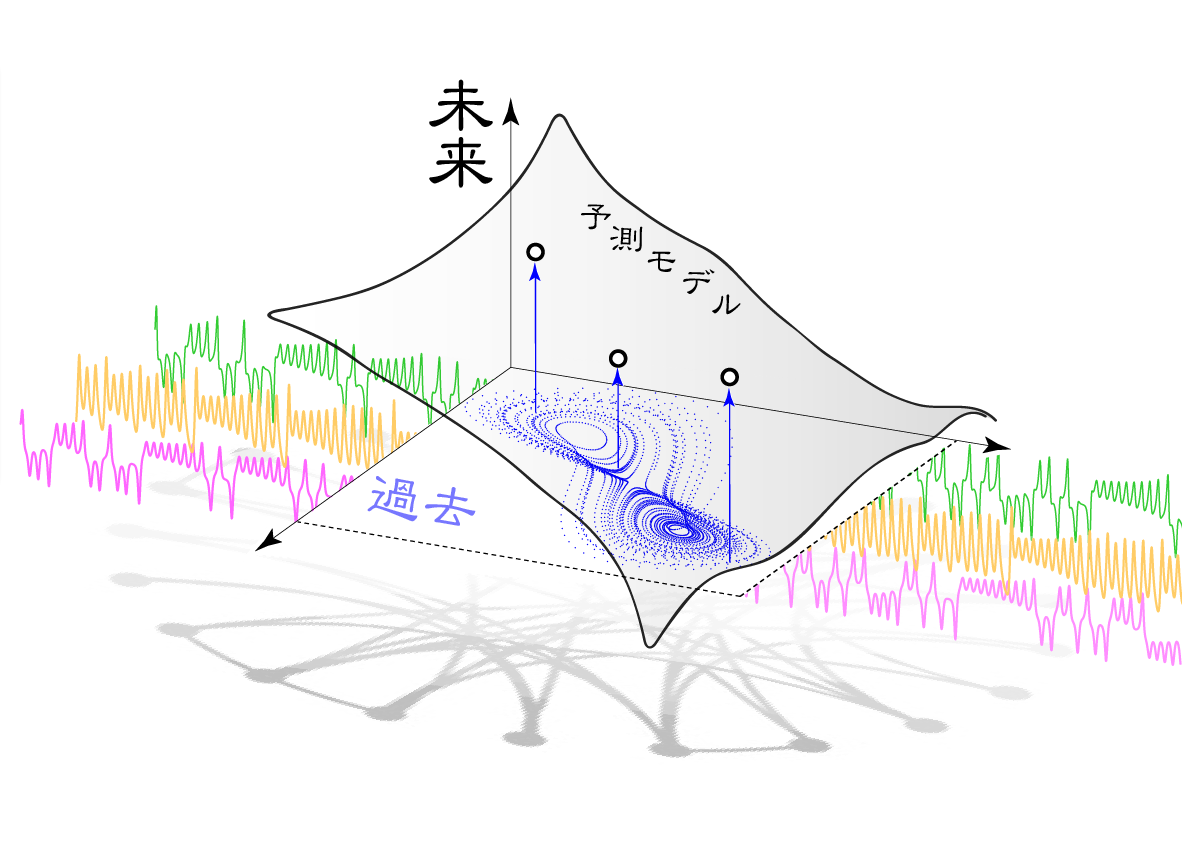

↑ We propose a new technical analysis based on the deterministic prediction theory like chaos. As you know, chaos theory used to be a hot topic in physics and economics, but the boom is almost over. Still, its prediction theory is really simple and can realize the highest level class of prediction models as a nonlinear-multivariate regression. Moreover, it is very familiar with technical analysis because it can be generalized as a formation analysis.

To compose my theory, there are some key ideas to improve prediction accuracy by following the majority decision and to select profitable investment targets in terms of better prediction accuracy. These whole ideas were named "spatiotemporal technical analysis" because the chaos prediction uses local neighbors in a state space to follow the same formation pattern.

Finally, as applications, our theory can be used for the Bollinger bands and for the portfolio theory. This is presented at IFTA2013 conference in San Francisco.

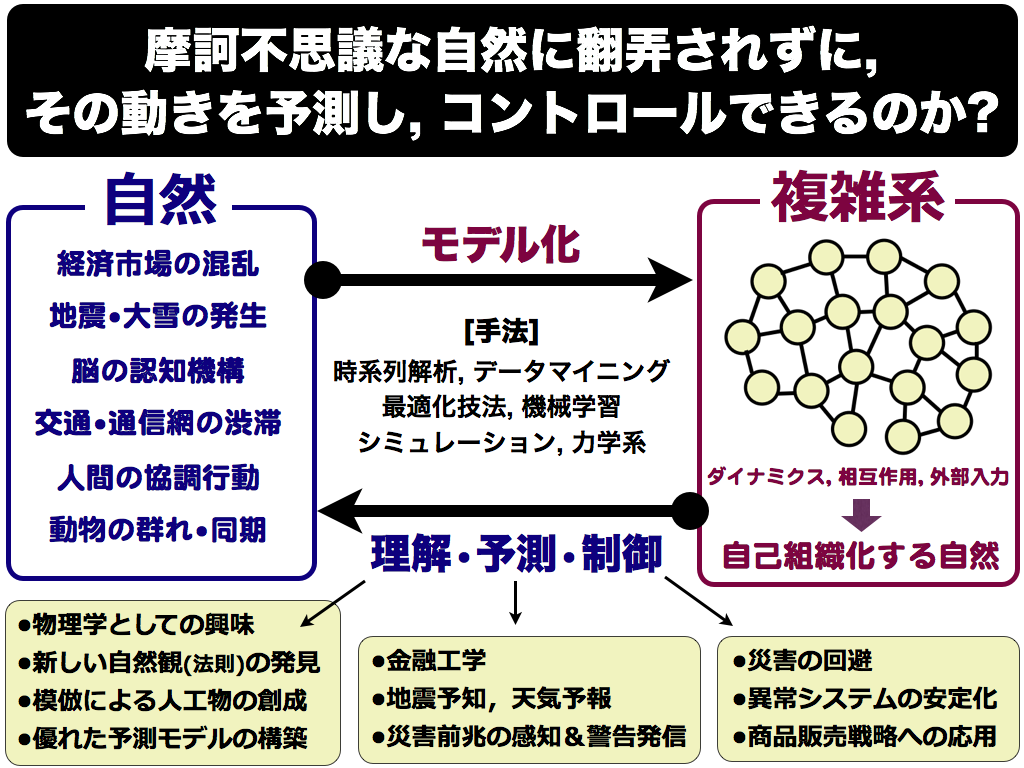

↑ 複雑怪奇な自然現象(=時系列データ)に隠れたルールを発見し, 未来の動きを予測する